Is Your Uniform on the Right Side of the Tax Law?

/At 4Couture we’re passionate about making sure your team are looking their best - we believe ‘It’s all in the detail’ and you’ll hear us saying this a lot!

We’re not only happy to help when it comes to the world of corporate garments, but the nitty gritty too. This includes ensuring you understand best practice when it comes to benefits in kind and tax implications of giving your team a staff uniform. In our day to day activities we often come across clients that aren’t aware that giving their staff a uniform can be classed as a taxable benefit.

First and foremost it’s important that we’re transparent. We can guide you; supported by our 15 years of experience in providing uniform for retailers, business to business and many large companies across the UK and EMEA, however, we are not tax experts!! There is a written guide directly on the HMRC regarding uniform and PPE, check it out here. There is also a wealth of knowledge you can access from your book keeper or tax consultant.

What is a tax-free uniform?

HMRC allows two types of tax-free clothing to be given to staff by their employer, and these include;

Safety & Protective Clothing – which an employee needs to do their job – think overalls, protective gloves or boots that aid the wearer in their day-to-day workplace.

Uniform – a set of clothing that an employee only wears to work – if a wardrobe has clearly visible and permanent branding e.g. Police Officer, Nurse or Fire-fighter.

The above sounds pretty straight forward if you're a Fire Fighter or a Police Officer, however in our experience there are finer details that must also be considered;

If you’re working in a hotel or hospitality, part of a reception team or in retail it may not be so obvious to customers or clients that your team are wearing a corporate uniform. For example, if you’re delivering suited garments, there a couple of questions you should ask yourself;

Can you or your staff wear the garments out at the weekend without looking like you’re in your uniform?

Can customers easily recognise you or your team?

If your answer is YES to the first question and NO to the second, then you’re potentially at risk of giving your staff a benefit in kind, which your staff will need to declare and will be taxed on.

What is a benefit in kind?

A benefit in kind is a benefit that an employee receives that is not included in their salary. The most common benefit you may be aware of are; company cars, or private medical insurance, but uniform can fall under this bracket too. For further information about benefits in kind read on here. As an employer, if the uniform you supply does not meet HMRC tax-free criteria the garments will need to be declared on a P11D and your employee will be liable to pay tax out of their own personal tax allowance- which could make for some unhappy staff :(

Another key point is the communication and delivery of uniform to your team, a great way to do this is by developing a Dress Code/Uniform Guideline (stay tuned for our dress code blog coming soon) which clearly states that the corporate wardrobe you are supplying is strictly to be worn whilst undertaking their job only and must be returned when they leave their role. It is also worth bearing in mind that in some circumstances, it's possible for your team to claim back uniform care and repair costs as an expense. Find more information on the annual budget for this here.

How can I make my uniform tax-free?

The best advice we can give to ensure our clients are abiding by HMRC guidelines, (should you ever be inspected!) is through branded garments and there are a number of ways of which to do this. Here are some examples of the branding techniques we use on a typical basis to make sure your staff stick to wearing the uniform you’ve supplied and in the workplace only...

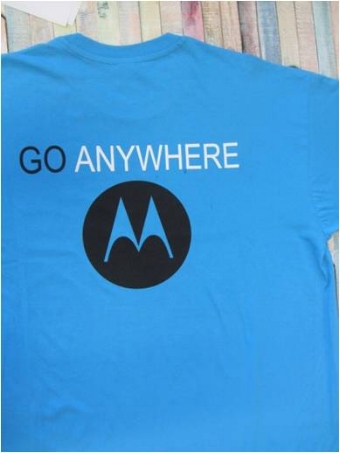

Printing – A perfect permanent type of branding, typically used for promotional wardrobe, which will meet HMRC guidelines. Print is ideal for creative, detailed artwork and a great way to pair your brand identity with garments such as coloured T-shirts or Leisurewear etc. Screen printing, Vinyl or heat press branding is ideally suited to making a bold and eye-catching statement, but that’s not to say it can’t be minimal and subtle too.

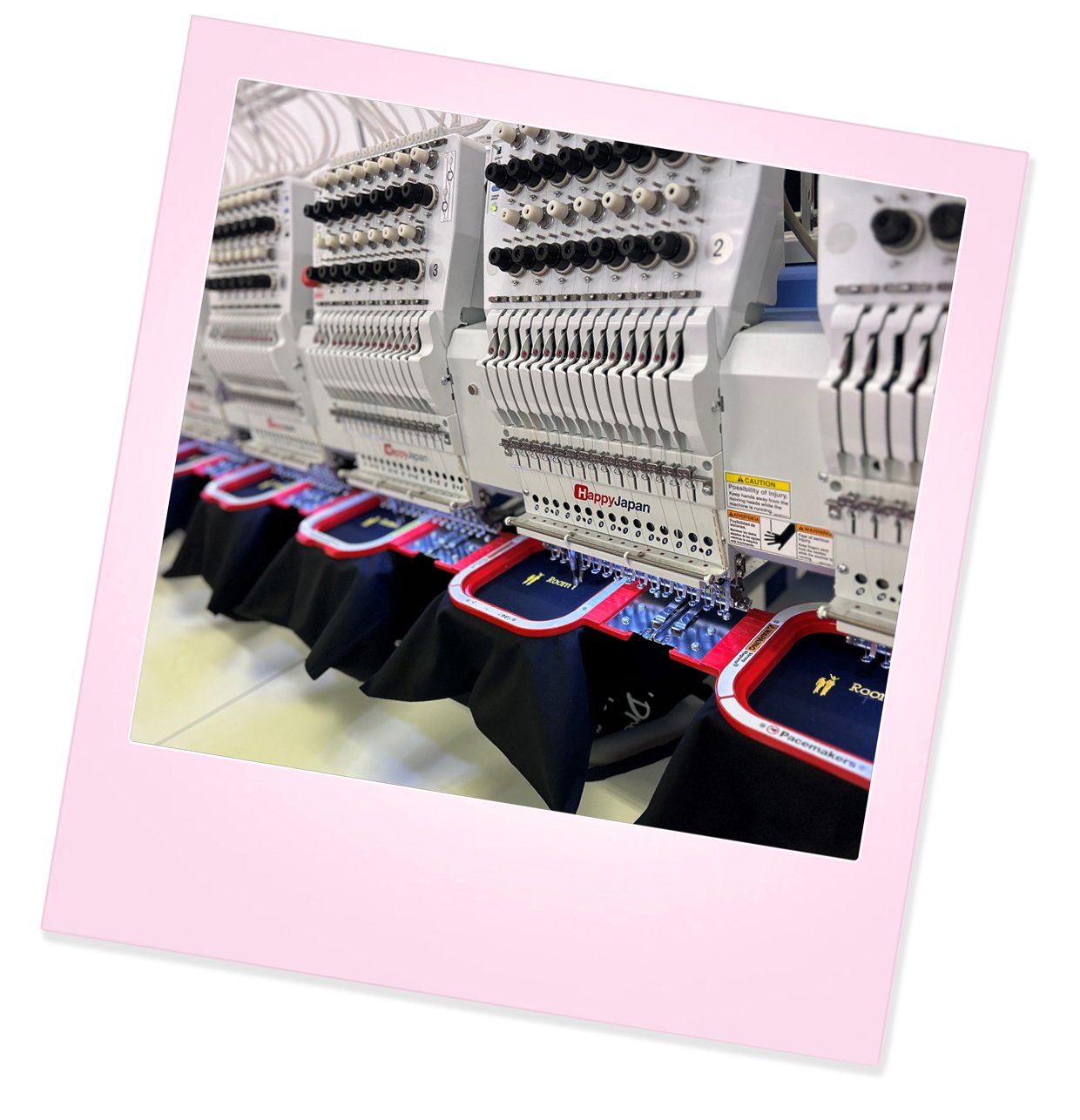

Embroidery – Branding does not always have to be big bold, and in your face to qualify. It does however; have to be clearly visible and not something your staff could try to style outside of the workplace. Our most common use of branding onto corporate wardrobe is Embroidery.

Embroidery works well to meet HMRC guidelines as it is a long lasting permanent solution, has a professional finish and a number of positions or ‘spots’ to chose from. Most commonly, embroidery is placed on the front left or right of the wearers’ chest. For a more understated approach the nape of neck or back pocket of a trouser works well as a subtle attention to detail.

Bespoke Tax Tabs - For some roles and corporate uniform looks, it is justified that you don’t want over the top branding. Over the past few years, a ‘Smart Casual’ uniform style has become increasingly popular with our clients and anything 'too corporate' can be classed as too serious. To add a little brand flair that doesn’t attract too much attention a bespoke branded woven ‘Tax Tab’ is the perfect tool which can be placed onto lightweight garments which won’t take embroidery or print techniques. Our in-house seamstresses can permanently attach them to garments of your choice in a number of places but remember, they need to be visible. (eg a branded neck label inside a garment is unlikely to be enough)

With the financial year coming to an end, now is the time to check you have approached your uniform policy correctly. If you’d like to see more examples of our work or have any questions, (like I said we’re not the HMRC but we can definitely help guide you with uniform that’s not only stylish but tax abiding too!) then drop us a line, we'd love to hear from you.